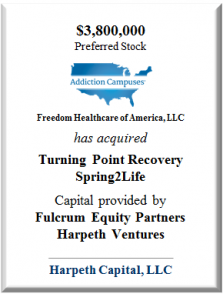

Harpeth Capital, LLC is pleased to announce that it served as exclusive financial advisor to Freedom Healthcare of America, LLC d/b/a Addiction Campuses in connection with the acquisitions of Turning Point Recovery, a North Mississippi and Memphis, TN-based provider of addiction treatment and behavioral health services, and Spring2Life, a provider of addiction, recovery and behavioral services with a spiritual focus based in Murfreesboro, TN. Fulcrum Equity Partners led a $3.8 million Series A financing in support of the management team. Harpeth Ventures also participated in the equity raise.

At a time when the need for treatment is growing rapidly, Addiction Campuses has assembled a deep management and operational team focused on sustained recovery and outcomes. Said Brent Clements, Founder and CEO, “Unfortunately, addiction and other behavioral health issues are becoming increasingly prevalent throughout our country. At Addiction Campuses, we have treatment plans and processes that result in successful outcomes and help our patients lead healthy, productive lives going forward. The team at Harpeth Capital understood our vision from day one, helping us determine the necessary capital need, manage a process that included meetings with a mix of potential investors, and negotiate and close a transaction within a very short time frame. We couldn’t be more excited about the support from Fulcrum Equity Partners and feel that Harpeth Capital found the perfect partner for us. We plan to aggressively seek other locations throughout the country and look forward to working with Harpeth Capital and Fulcrum to facilitate our growth.”

“We were immediately impressed with Brent and his team and their passion for helping individuals deal with what is unfortunately a growing problem in our society,” said Chuck Byrge, Head of Investment Banking at Harpeth Capital. “We appreciate the trust that Brent and his team put in our firm to get this deal done and look forward to the opportunity to work with Addiction Campuses as it executes on its growth strategy.”